Planned &

Deferred Gifts

Future Giving for Future Needs

Planned and deferred gifts to Family & Children Services allow donors to impact families and children in our community well beyond their lifetime. In many cases, planned giving provides helpful financial benefits to the donor through tax incentives.

As part of a thoughtful, comprehensive estate plan, gifts to Family & Children Services provide a way to complete a lifetime of giving or make a significant gift that was not possible during one’s lifetime.

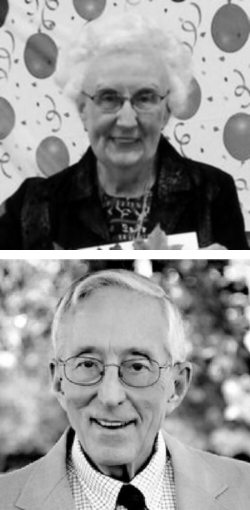

The Quiet Legacy of Jack and Helen Wattles: Building a Vibrant Community in Kalamazoo

Jack and Helen Wattles loved Kalamazoo. Helen was born here, while Jack was from South Bend. They met on a blind date at Western Michigan University.

Believing strong communities were built on connections, support, and opportunity, their philanthropy focused on meaningful, lasting contributions, especially to camps. Both valued summer camps’ role in childhood development and their ability to teach resilience, teamwork, and self-reliance.

Jack served over 40 years on the Kalamazoo YMCA board and helped found the Sherman Lake YMCA Outdoor Center, aligning with his values of honesty, caring, respect, and responsibility. Longtime supporters of Family & Children Services, the Wattles helped launch its Summer Enrichment Program, ensuring access to camps and other summer enrichment opportunities for children. Their legacy of quiet generosity continues through the Wattles Family Foundation, enriching lives and strengthening communities.

Planned giving allows donors to impact families and children in our community well beyond their lifetimes. We appreciate the Wattles family and donors like them who continue to support this community long after they are gone.

Serving Beyond Their Years: The VanWestrienens

Paul and Barbara VanWestrienen exemplified service, generosity, and commitment to their community.

Dedicating themselves to helping others, Paul served over 20 years on the Family & Children Services board and Barbara appreciated that our services impacted children.

They gave intentionally, utilizing an enduring IRA fund to ensure their philanthropy has lasting impact by supporting local causes.

Planned and deferred gifts include:

- Bequests.

- Retirement assets, including individual retirement accounts (IRAs), 401K, and Keogh plans.

- Gifts of securities and property.

- Life insurance.

- Charitable lead trusts.

- Life Income Gifts such as charitable gift annuities, charitable remainder trusts, and pooled income funds.

As always, Family & Children Services encourages you to consult with your attorney, accountant, or other professional advisor to confirm the financial benefits of a planned gift, review any legal document associated with a gift, and determine its appropriateness in the context of your personal financial circumstances.

Testimonial

“My family and I would like to thank you so very much for the donations. Because of your generosity, we still have our apartment to call home. Times have been so very hard the past year with the lack of work and the cold winter. I, as a father, haven’t been able to provide a steady enough income for my family. We thank you all so very much! You’ve shown, in more than words, how important it is to give.”

DonateMake an Impact

Gifts to Family & Children Services, Inc. are deductible for income tax purposes. We welcome gifts of all kinds, including cash, checks, credit cards, gifts of stocks, IRA distributions, Donor Advised funds, and gifts-in-kind.

Consider Making A Gift!

Please consider making an annual gift and including us in your will, trust, or estate plan. It’s a simple way to make an impact and leave a lasting legacy.

For more information, or to accommodate large and unique gifts, contact Courtenay VanderMolen in the Family & Children Services Development Office by phone at 269.344.0202 or by email.